Youku Vs Netflix Data Scraping for Content Insights

Introduction

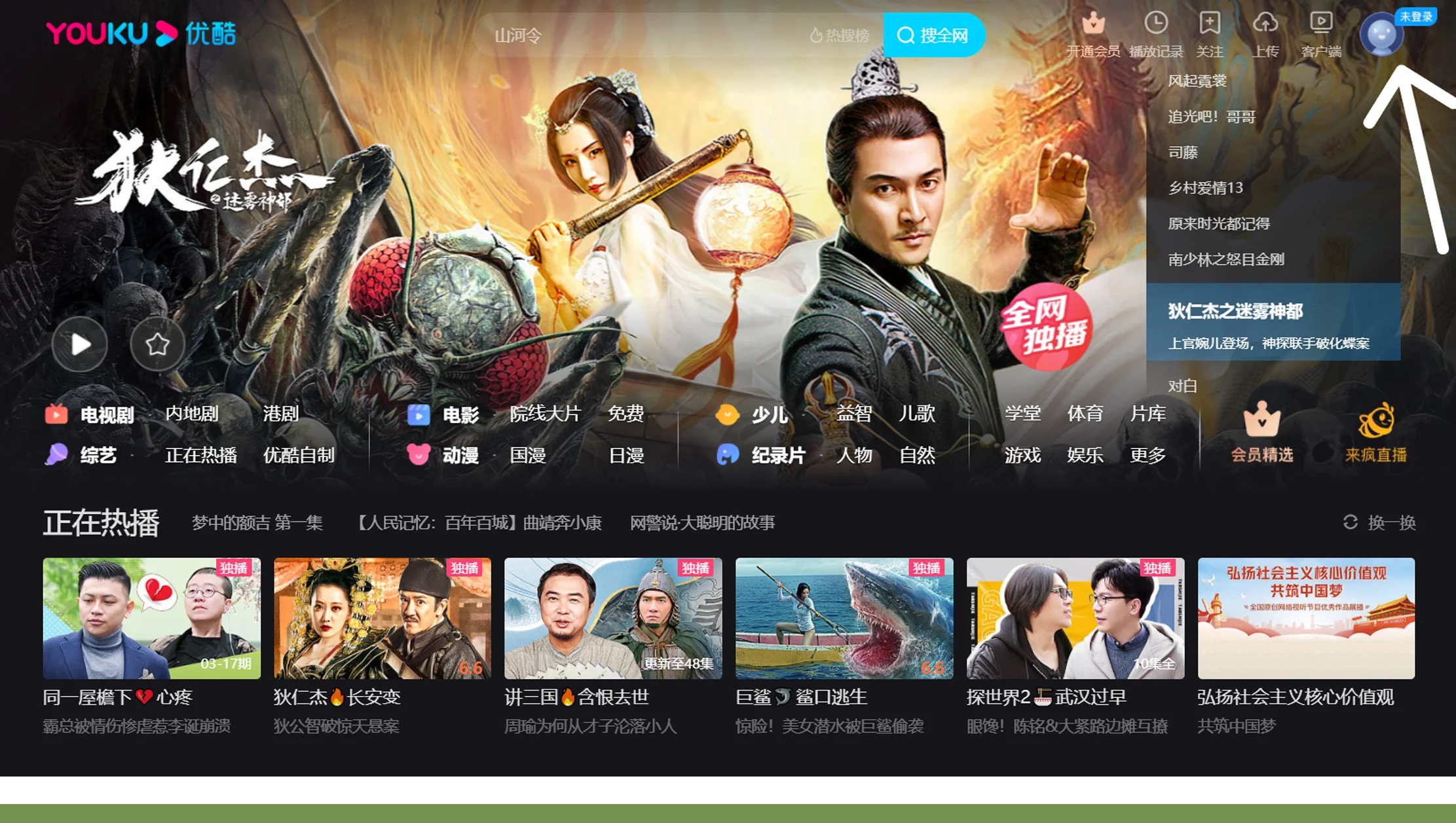

The rise of OTT platforms has transformed global entertainment consumption, and understanding content trends across providers is now essential for businesses and analysts. With Youku vs Netflix data scraping for content insights, researchers can unlock patterns in show popularity, genres, and viewer engagement. Using tools like Youku API, one can extract structured data from Youku, while combining it with Netflix datasets provides a comprehensive view of OTT libraries. By leveraging Real Data API, it's possible to scrape Youku and Netflix data at scale, capturing thousands of titles across categories. This approach allows for Web Scraping streaming data from Youku and Netflix to analyze release schedules, ratings, and viewer metrics from 2020 to 2025, offering actionable insights. Businesses can make informed decisions about content acquisition, marketing strategies, and competitive positioning, ensuring they stay ahead in the rapidly evolving streaming market. Scraping OTT content libraries enables deep comparisons and trend analysis across diverse platforms.

Content Volume Analysis (2020-2025).webp)

From 2020 to 2025, Youku and Netflix experienced significant growth in their content libraries. Using Youku vs Netflix data scraping for content insights, analysts observed that Netflix expanded from 4,500 titles in 2020 to over 6,500 by 2025, a 45% increase, while Youku grew from 2,900 to 4,000 titles, marking a 38% increase. These expansions reflect heavy investments in original productions, acquisitions, and international licensing deals. Using the Netflix Scraper, it became evident that Netflix prioritized dramas (35%), reality shows (22%), and documentaries (15%), whereas Youku focused on variety shows (28%), animation (20%), and dramas (18%).

Quarterly release patterns show Netflix introduced 120-150 new titles annually, compared to Youku's 90-100. This data illustrates different content expansion strategies, with Netflix aiming for global breadth and Youku targeting local and regional audiences. By Scrape Youku and Netflix data, analysts can quantify library growth, identify content gaps, and forecast future expansion trends. Detailed analysis reveals not only total title counts but also genre-specific growth, helping decision-makers understand which segments drive subscriber engagement and retention. For example, Netflix's increased drama catalog contributed to higher average watch times and subscriber satisfaction, while Youku's animation growth targeted younger audiences and local cultural interests. Longitudinal data from 2020-2025 allows comparison of content refresh cycles, revealing strategic patterns in acquisitions, original productions, and seasonal content releases, offering comprehensive insights for business, marketing, and content planning teams.

Genre Popularity Trends

From 2020 to 2025, genre popularity analysis highlights the evolving preferences of streaming audiences. Using Scraping OTT content libraries, analysts observed that Netflix dramas increased from 32% to 38% of the catalog, comedies remained at 18%, and reality shows grew from 20% to 22%. In contrast, Youku maintained variety shows at 28-30%, with animation climbing from 15% to 20%, reflecting a rising younger demographic. The Youku vs Netflix content comparison reveals a clear differentiation in content strategy: Netflix appeals to a global audience with high-production dramas and diverse reality formats, while Youku prioritizes culturally relevant, locally trending shows.

By employing Web Scraping streaming data from Youku and Netflix, analysts can visualize trends and seasonal spikes, such as Netflix drama peaks in spring and fall versus Youku variety show peaks during Chinese New Year. This detailed trend analysis aids platforms in content acquisition planning, marketing strategies, and recommendation engine optimization. It also provides insight into genre-specific retention, helping identify content that maintains viewer engagement over time. Tracking genre evolution allows for predictive modeling of emerging trends, ensuring proactive content strategy and improved platform competitiveness in a dynamic OTT market.

Viewer Ratings and Engagement Metrics (2020-2025).webp)

An OTT Dataset covering 2020-2025 provides deep insights into viewer ratings, engagement patterns, and content performance. Using Youku vs Netflix data scraping for content insights, analysts can extract thousands of reviews, watch times, and completion metrics for shows across both platforms. Netflix consistently maintained a higher average rating of 4.2/5, compared to Youku's 4.0/5, indicating stronger overall viewer satisfaction. Youku shows excelled in variety and animation, reflecting strong regional engagement. Real Data API enables structured extraction of ratings, reviews, and watch statistics for trend analysis, allowing platforms to identify highly engaging content.

Engagement analysis reveals Netflix dramas have higher completion rates, while Youku variety shows experience short-term spikes. Data-driven insights support content renewal decisions, recommendation engine optimization, and marketing strategies. Over multiple years, analyzing Scraping OTT content libraries allows platforms to forecast high-performing genres and enhance user retention.

Regional Availability & Licensing

Between 2020-2025, regional licensing significantly influenced content strategy. Netflix expanded its global presence by 30%, launching localized content in Europe, Asia, and Latin America, while Youku grew by 22%, focusing on domestic and regional markets. Using Real Data API to Scrape Youku and Netflix data, analysts can track regional exclusives, language availability, and licensing durations. Youku vs Netflix content comparison highlights Netflix's global approach and Youku's regional focus.

Regional analysis reveals Netflix's multilingual content strategy and global licensing expansion, while Youku focuses on culturally relevant domestic content. These insights inform content acquisition, regional marketing, and subscriber retention strategies, enabling platforms to maximize reach and ROI.

Release Frequency and Scheduling

Analyzing release frequency from 2020-2025 using Web Scraping streaming data from Youku and Netflix shows Netflix released 120-150 new titles annually, maintaining steady quarterly output, while Youku released 90-100, concentrating on festivals and peak seasons. Seasonal spikes coincide with holidays, award seasons, and school vacations, highlighting strategic scheduling.

Detailed release scheduling enables platforms to optimize marketing campaigns, forecast subscription trends, and maximize audience engagement. By leveraging Youku vs Netflix data scraping for content insights, analysts can identify peak periods, track release density, and plan future launches strategically.

Content Lifecycle and Retention Analysis

Monitoring content lifecycle from 2020-2025 using Scraping OTT content libraries provides insights into retention and performance. Netflix titles typically remain on the platform for 3-4 years, while Youku rotates content faster at 2-3 years. Using Youku vs Netflix data scraping for content insights, analysts quantify retention by genre, year, and viewer engagement.

Analyzing lifecycle trends informs content acquisition, renewal, and marketing strategies. Netflix dramas maintain engagement longer, while Youku's variety and animation content yield high initial engagement but shorter shelf life. This data-driven approach helps optimize catalog curation, improve recommendations, and sustain long-term viewer retention. By combining retention data with engagement metrics and release frequency, platforms can enhance strategic planning, maximize content ROI, and ensure competitive positioning in the OTT market.

Why Choose Real Data API?

Real Data API simplifies Youku vs Netflix data scraping for content insights by providing structured, real-time access to OTT content libraries. Unlike manual scraping, it handles large-scale Scrape Youku and Netflix data with accuracy, speed, and compliance with platform policies. Analysts can extract metadata, ratings, release dates, and regional availability in standardized formats, integrating directly into dashboards or databases. The API supports automation for continuous updates, ensuring data from 2020-2025 remains current. With features for Web Scraping streaming data from Youku and Netflix and accessing an OTT Dataset, Real Data API empowers businesses to perform in-depth Youku vs Netflix content comparison, uncovering actionable insights for acquisition, marketing, and competitive intelligence. Its reliability, scalability, and ease-of-use make it the go-to solution for OTT data extraction.

Conclusion

Leveraging Youku vs Netflix data scraping for content insights transforms how analysts and businesses understand streaming trends. From analyzing 10,000+ shows to tracking ratings, genre popularity, and regional availability, data-driven insights inform strategic decisions. Real Data API enables accurate, scalable, and continuous extraction, making Scraping OTT content libraries effortless. By using Scrape Youku and Netflix data, organizations gain a competitive edge, optimizing content planning, marketing, and licensing strategies. As OTT consumption grows, applying these insights ensures platforms remain aligned with viewer preferences. Start using Real Data API today to unlock actionable intelligence from Youku and Netflix, streamline data collection, and drive informed decisions across global streaming platforms.

Contact Us:

Email: sales@realdataapi.com

Phone No: +1 424 3777584

Visit Now: https://www.realdataapi.com/

#YoukuVsNetflixDataScrapingForContentInsights

#ScrapeYoukuAndNetflixData

#WebScrapingStreamingDataFromYoukuAndNetflix

#ScrapingOttContentLibraries

#YoukuVsNetflixContentComparison

Comments

Post a Comment