Total Wine Product Data Scraper - Monitor Liquor Sales Growth

Introduction

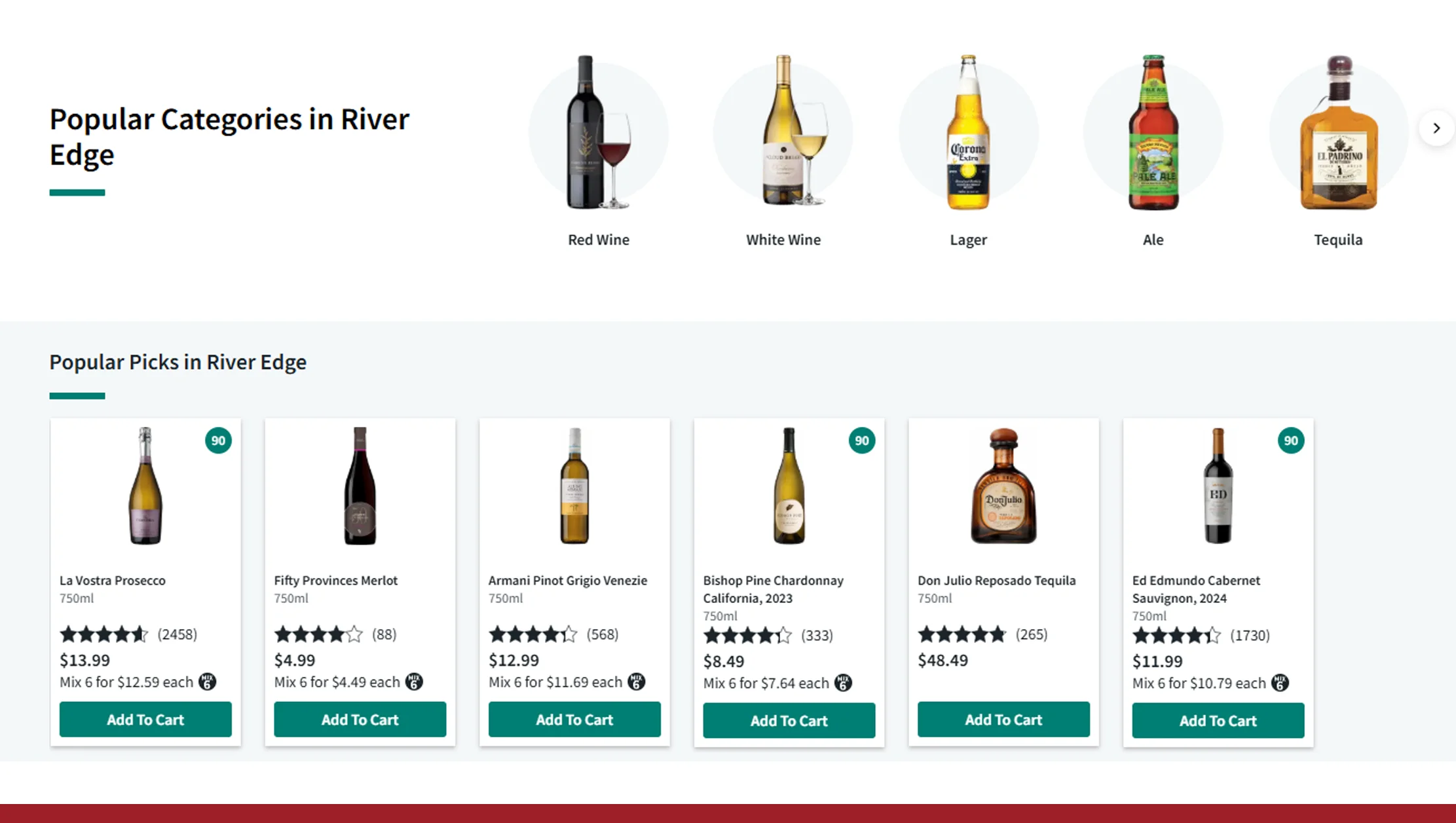

In the rapidly evolving digital marketplace, staying ahead of competitors in the liquor and wine business means harnessing data at scale. That's where the Total Wine API comes into play — a tool that powers wine and liquor intelligence by enabling automated access to pricing, inventory, and product listings. Armed with this, businesses can implement strategies rooted in real-world insights rather than guesswork.

Growing consumer demand, evolving purchasing behaviors, and the shift toward omni-channel retail have all amplified the importance of data-driven decision making. With a reliable Total Wine product data scraper, operators of wine shops, liquor chains, distributors, and analytics firms can continuously monitor product-level dynamics, respond to pricing shifts, and capture emerging trends early. In this blog, we'll show how leveraging a robust scraper on Total Wine helps you seize a competitive edge.

Market Growth, Business Impact & How to Use the Total Wine API

The beverage retail market is no longer a gut-feel game. To win shelf space and margin, you need continuous, product-level intelligence. The Total Wine API is the gateway for pulling structured product and pricing data at scale, and when paired with a robust Total Wine product data scraper you convert raw site content into actionable signals: national price trends, store-level promotions, SKU delists/adds, and region-by-region demand shifts. This section explains the business case — the revenue upside, how the 4.6% CAGR matters in practical terms, and how Total Wine API scraping can be structured into operational pipelines.

Consider a baseline retailer doing USD 100 million in 2020. At a 4.6% CAGR (the benchmark we're monitoring), that retailer would hit roughly USD 125.21 million by 2025. That gap between 2020 and 2025 is where data intelligence pays for itself: identifying promotion timing, matching competitor pricing, and reallocating inventory to high-demand stores.

Sales growth example (2020–2025)

| Year | Sales (USD millions) |

|---|---|

| 2020 | 100.00 |

| 2021 | 104.60 |

| 2022 | 109.41 |

| 2023 | 114.44 |

| 2024 | 119.70 |

| 2025 | 125.21 |

Interpreting these numbers: moving from a reactive pricing cadence (weekly/monthly) to a near-real-time cadence (daily or hourly ingest + analytics) shortens response time to competitor sale events and fast-changing demand patterns. A Total Wine product data scraper operating at scale enables you to compare your price and assortment performance directly against Total Wine's public listings, giving you a continuous benchmark and the ability to detect transient pricing experiments (flash discounts, limited-time bundles) that would otherwise be invisible in quarterly analytics.

Operational notes:

- Ingest cadence: daily snapshots are table stakes; hourly or store-refresh frequency unlocks promotional arbitrage and dynamic repricing.

- Data fusion: merge product-level price + availability with your POS to compute share shifts and margin erosion in near-real-time.

- ROI ladder: a single well-timed price match or inventory reallocation that prevents a stockout during a surge can pay for the ingestion infrastructure manifold.

In short, a measured, repeatable Total Wine API + extraction pipeline transforms a 4.6% CAGR narrative into tactical plans (pricing rules, promo timing, stocking strategy) that let you capture more of the growth curve. Using a best-practice Total Wine product data scraper is the first step to turning external market movement into internal competitive advantage.

Building and Using the Total Wine & More Liquor Dataset

A business-ready dataset is not a "dump" — it is a structured, timestamped record optimized for analytics and automation. The Total Wine & More Liquor Dataset should be designed for repeatable queries and ML-ready consumption: store-level presence, price history, promotional flags, rating metadata, SKU hierarchies (brand → varietal → vintage → pack size), and normalized category tags. With such a dataset you can run cohort analyses (regional vs national), compute price elasticity by SKU, and feed forecasting models.

A useful engineering pattern is daily snapshots with delta tracking (store × SKU × timestamp). That approach yields a dataset that grows predictably. Consider a mid-sized setup that tracks ~10,000 SKUs daily: that's ~3.65 million rows per year (one row per SKU × day). If the number of tracked SKUs or coverage grows, the dataset scales accordingly.

Dataset size example (tracked rows, millions, 2020–2025)

| Year | Tracked Rows (millions) |

|---|---|

| 2020 | 3.65 |

| 2021 | 3.94 |

| 2022 | 4.26 |

| 2023 | 4.60 |

| 2024 | 4.97 |

| 2025 | 5.37 |

Interpretation: with consistent daily ingestion, your dataset becomes a time machine — you can slice back to the exact date a price was first introduced, when a promotion spread across regions, or when an SKU began to disappear from inventory. From 2020–2025 this steady accumulation of records makes advanced analytics possible: clustering SKUs by demand seasonality, estimating cannibalization after promotions, or training a demand-forecasting model.

Key fields to include in the Total Wine & More Liquor Dataset:

- product_id, store_id, timestamp

- list_price, sale_price, promotion_type

- inventory_status (binary / qty where available)

- category, brand, vintage, size

- ratings_count, average_rating, label_image_hash

Use-cases unlocked by the dataset:

- Price elasticity modeling by SKU-region cohort.

- Regional assortment optimization (which SKUs to push to a DC vs local replenishment).

- Identifying permanent vs transient price compression (one-off flash sales vs long-term reprices).

- Serving a promotion-recommendation engine to merchandising teams.

Finally, building the dataset with a clear contract — column types, update cadence, retention policy — reduces downstream friction. This is the dataset that allows you to move from "we think" to "we know" across the 2020–2025 period and beyond.

Unlock powerful insights — build and use the Total Wine & More Liquor Dataset to track trends, optimize pricing, and boost sales!

Get Insights Now!Engineering the Total Wine Scraper: Scale, Robustness & Wine pricing data extraction

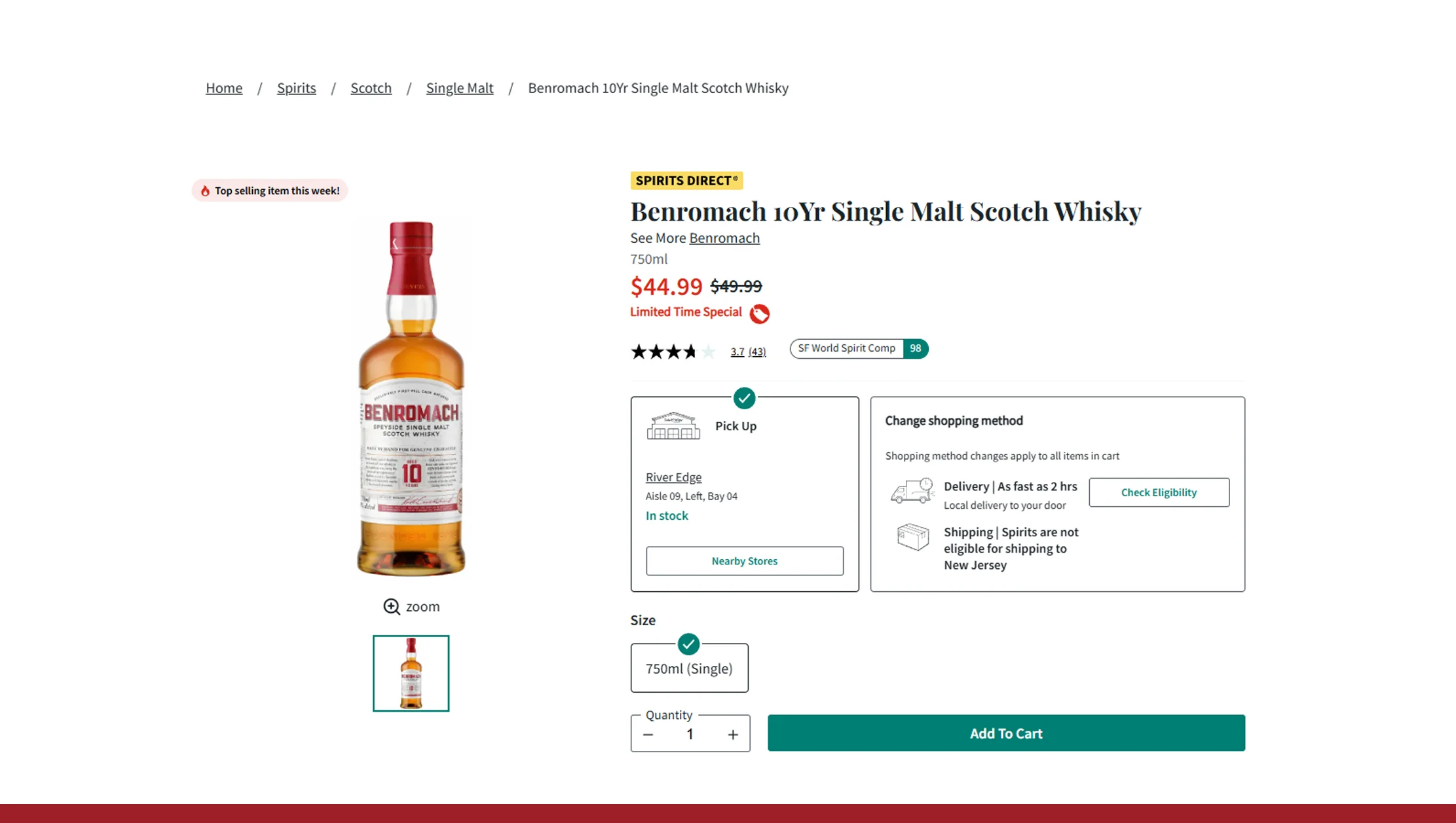

A production-grade Total Wine Scraper must be engineered for resiliency: sites change layout, labels evolve, stores add/remove inventory, and anti-bot defenses can appear. This section digs into engineering patterns and the nuts-and-bolts of Wine pricing data extraction so your pipeline remains stable and accurate across the 2020–2025 product evolution window.

Catalog churn is real. Suppose a baseline catalog of 25,000 SKUs in 2020 grows as new private-labels and imports arrive. Catalog expansion and SKU versioning require the scraper to capture both structure and state. A practical example: starting at 25,000 SKUs in 2020 and growing 5% annually results in a catalog of roughly 31,907 SKUs by 2025 — a significant increase in coverage and indexing needs.

Catalog size example (SKUs tracked, 2020–2025)

| Year | SKUs tracked |

|---|---|

| 2020 | 25,000 |

| 2021 | 26,250 |

| 2022 | 27,562.50 |

| 2023 | 28,940.62 |

| 2024 | 30,387.65 |

| 2025 | 31,907.03 |

Engineering checklist for a resilient Total Wine Scraper:

- Hybrid retrieval: prefer lightweight API/JSON endpoints when available; fall back to HTML parsing and headless browser snapshots for dynamically rendered pages.

- Layout-agnostic parsing: rely on semantic anchors (structured JSON-LD, data-* attributes) instead of brittle CSS selectors where possible.

- Change detection: store page and JSON snapshots and only persist deltas to save storage and speed downstream processing.

- Anti-bot hygiene: respectful throttling, proxy pools, user-agent rotation, and progressive backoff. Implement a robust retry and error classification strategy so transient failures don't cascade.

- Normalization layer: standardize units (ml, L), currency rounding rules, and size parsing to prevent downstream model confusion.

Workflow example:

- Discover product listing (store-level and national index).

- Fetch product details: price blocks, promo labels, rating objects.

- Normalize pricing (unit price per 750ml, per liter) for apples-to-apples analysis.

- Persist snapshot + delta; index a canonical product_id.

Operational metrics to monitor (2020–2025 perspective):

- scrape success rate (target > 98% for critical endpoints),

- time-to-ingest (should remain stable as catalog grows),

- change-detection ratio (how often product pages actually change between snapshots).

When done correctly, your Total Wine Scraper becomes a low-latency feed for analytics — feeding pricing engines, assortment tools, and daily reporting with high fidelity, even as the site and market evolve.

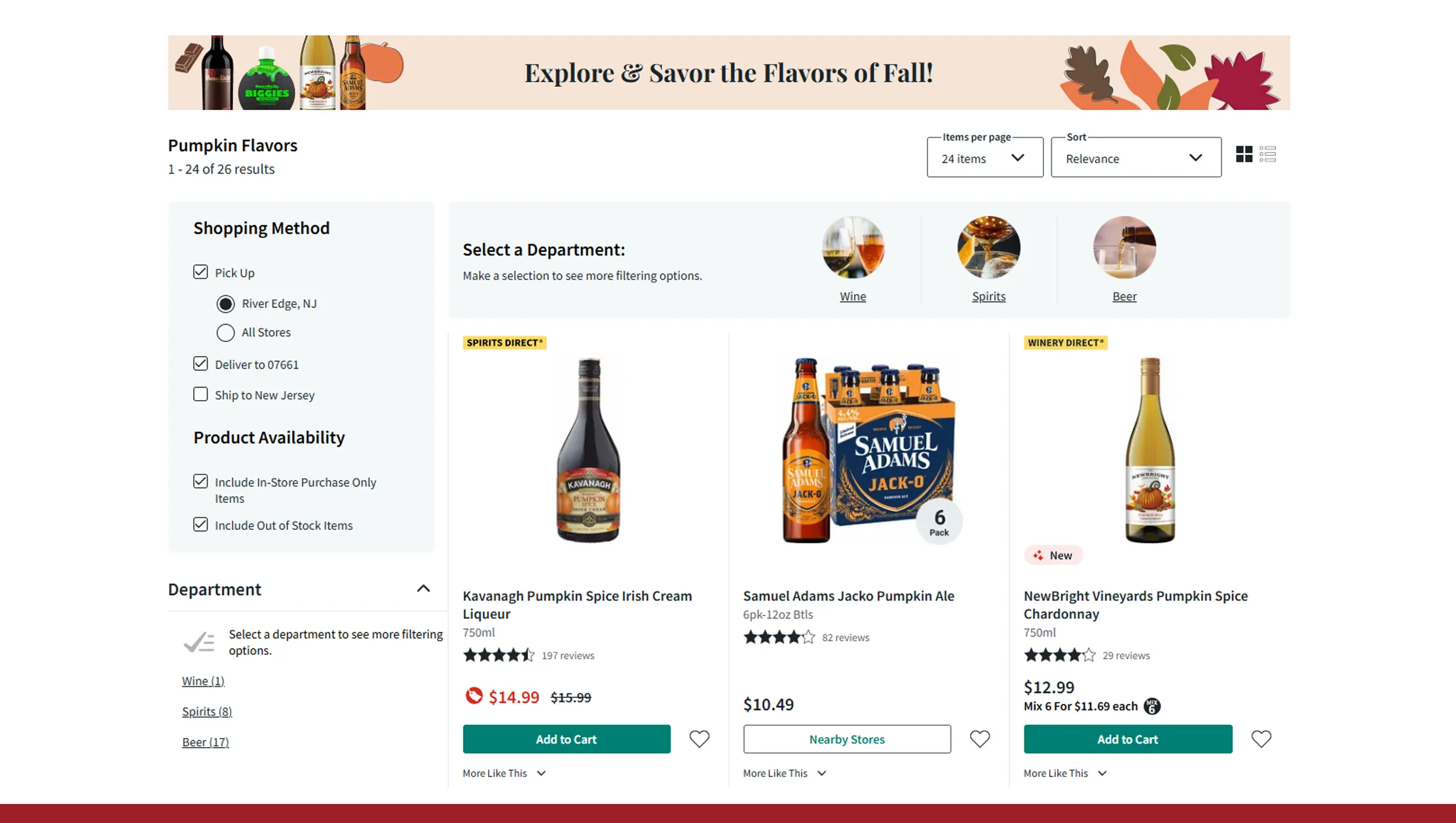

Inventory Signals: The Total Wine Inventory Monitoring Dataset

Price alone tells half the story. Availability and stock dynamics provide early warnings about supply constraints, regional demand shocks, and promotional timing. The Total Wine Inventory Monitoring Dataset is designed to capture these signals across time and geography, enabling operational actions: re-allocations, surge forecasting, and stocking prioritization.

A minimal inventory record should include store_id, sku, stock_status (in-stock / out-of-stock), optional stock_qty if visible, and timestamp. Over time, these records reveal patterns — which SKUs repeatedly stock out in which markets, whether shortages are temporary (restocked in days) or chronic (weeks), and how stockouts correlate with price upticks.

Inventory stockout rate example (percent of SKU-days out of stock, 2020–2025)

| Year | Stockout rate (%) |

|---|---|

| 2020 | 6.00 |

| 2021 | 6.42 |

| 2022 | 6.87 |

| 2023 | 7.35 |

| 2024 | 7.86 |

| 2025 | 8.41 |

Interpretation: An increasing stockout rate across 2020–2025 can indicate supply chain stress, seasonal mismatch, or distribution bottlenecks. If a premium single-vineyard SKU shows frequent stockouts starting Q4 2023, but prices didn't rise until Q1 2024, that lag is an opportunity — you can move inventory in front of demand or negotiate conditional allocation with suppliers.

Analytics to run with the Total Wine Inventory Monitoring Dataset:

- Days-to-restock median per SKU by region (spot supply constraints).

- Stockout clustering (which stores/regions show correlated shortages).

- Stockout → price change lag analysis (does stockout precede price hikes and by how long?).

- Demand-signal amplification: detect when low inventory + high sell-through indicates a trending SKU.

Usage scenario: an automated rule flags any SKU with stockout rate rising to > 10% in a region and sustained daily sell-through exceeding expected baselines. That rule triggers an alert to merchandising and logistics to triage — move inventory, expedite replenishment, or adjust promotion plans.

By integrating the Total Wine Inventory Monitoring Dataset with transactional sales and pricing history, you get a 360° view: not just that a SKU is out-of-stock, but the expected revenue at risk, the promotional lift it might have driven, and the replenishment urgency. Those combined insights are what let you convert a reactive supply problem into a strategic inventory play.

Competitive Intelligence: Parallel Web Scraping Wine and liquor data to Track Wine & Liquor Market Trends

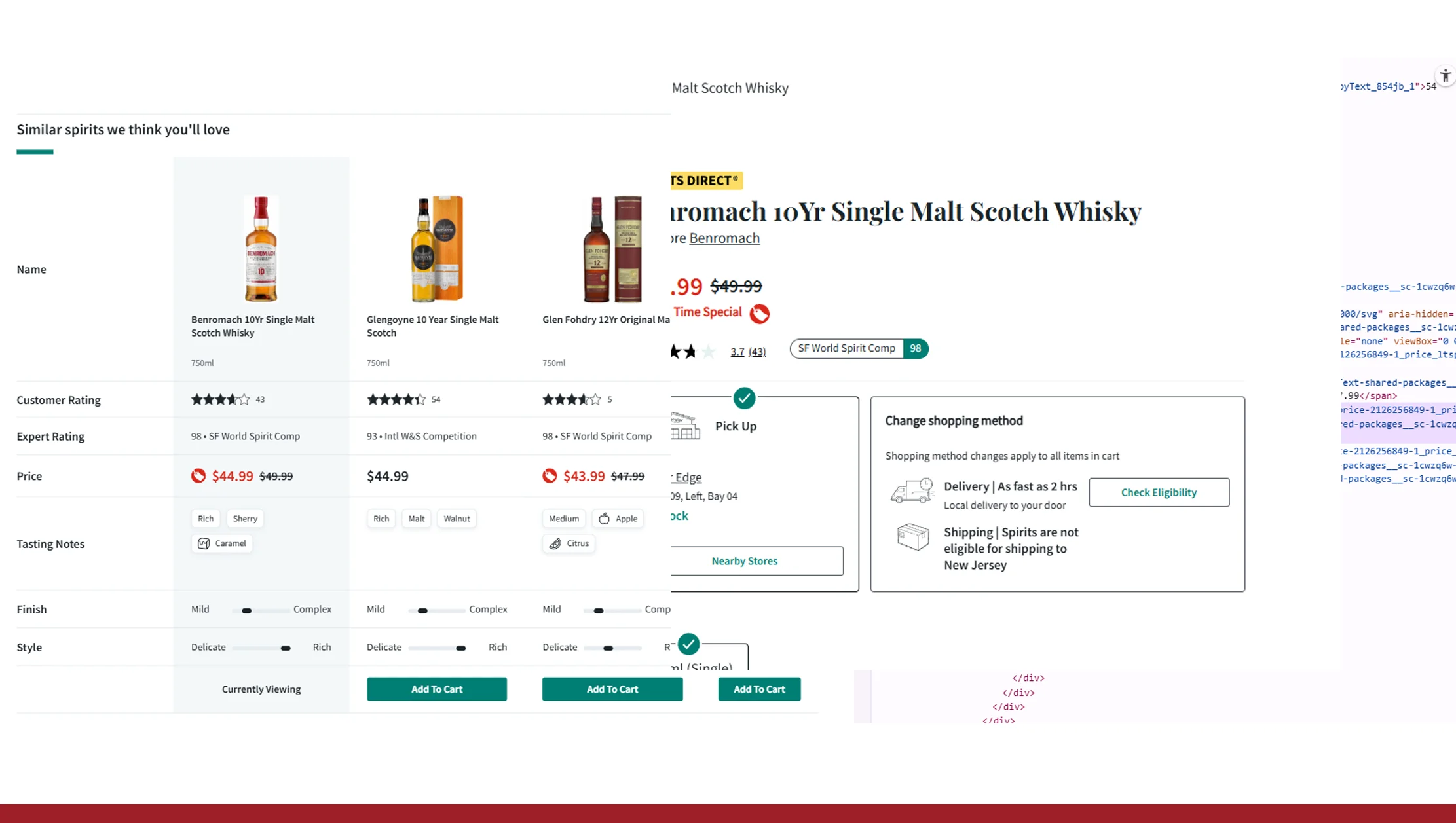

Competitive intelligence at scale requires breadth: Total Wine is a major anchor retailer, but you gain real advantage when you Track Wine & Liquor Market Trends across multiple retailers in parallel. Cross-retailer scraping reveals relative discounting intensity, SKU overlap, and where each retailer places promotional emphasis — insights that guide assortment, pricing, and promotional strategy.

A practical comparative snapshot across 2020–2025 shows how pricing dynamics and catalogue strategies shift. For example, average price for a middle-tier SKU might rise modestly over the 2020–2025 period due to input-cost inflation and premiumization trends; tracking competitors in parallel surfaces when one retailer systematically offers deeper discounts or less frequent promotions.

Average price example (USD, 2020–2025)

| Year | Avg. price (USD) |

|---|---|

| 2020 | 18.99 |

| 2021 | 19.37 |

| 2022 | 19.76 |

| 2023 | 20.16 |

| 2024 | 20.56 |

| 2025 | 20.97 |

Using a multi-retailer approach to Web Scraping Wine and liquor data lets you:

- Compute competitor discount rates and timing (who leads on Black Friday/Cyber Monday).

- Evaluate assortment overlap to identify exclusives and white-space SKUs.

- Detect portfolio shifts — is a competitor leaning into premium imports while another focuses on value bundles?

Use-case example: Q2 2023 shows a cluster of price experiments on a particular Chardonnay across three national chains. With concurrent scraping you can see which chain initiated the price drop, whether the drop was nationwide or store-limited, and whether the competitor recaptured margin after the experiment ended. Those signals help you decide whether a price-match or a targeted promotion is the right response.

Implementational notes:

- Standardize unit pricing (per liter or per 750ml) to compare across multi-pack promotions.

- Normalize brand names, pack descriptors, and vintage parsing to avoid match errors.

- Maintain per-retailer confidence scores (some retailers show quantity, others show only binary stock status).

When you stitch these signals together over 2020–2025, a clear narrative emerges: which retailers are competing on price, which on selection, and which on convenience — and that narrative directly informs strategy for assortment, promotions, and pricing.

Gain a competitive edge — use parallel web scraping to track wine & liquor market trends and uncover growth opportunities faster!

Get Insights Now!Real-time Monitoring: Alerts, Actioning & Real-time liquor price tracking

The final mile in operationalizing pricing and inventory intelligence is closing the loop: detect an event, prioritize it, and act. Real-time liquor price tracking is the backbone of this loop — it powers automated alerts, repricing engines, and promo-detection pipelines that let your commercial team act within hours, not weeks.

From an operational standpoint, alerts scale as ingestion cadence increases. A baseline system with hourly refreshes will capture many more micro-promotions than a daily-only pipeline. Consider a hypothetical alert volume growth as you move from coarse to fine ingest and as the catalog grows.

Alert volume example (events detected per year, 2020–2025)

| Year | Alerts detected |

|---|---|

| 2020 | 1,200 |

| 2021 | 1,500 |

| 2022 | 1,875 |

| 2023 | 2,343.75 |

| 2024 | 2,929.69 |

| 2025 | 3,662.11 |

What these numbers show: as you broaden SKU coverage and increase cadence, your detection surface expands. But raw alerts alone are noise — you need prioritization. Scoring rules might include:

- Revenue at risk (price/volume potential impact)

- Strategic importance (top-N SKUs, exclusives)

- Competitive delta (if competitor price < your price by threshold)

- Likelihood of persistence (flash vs sustained promo)

Action flows driven by Real-time liquor price tracking:

- Alert triggers for a high-impact competitor price drop.

- Automated rule evaluates margin headroom and either auto-reprices low-risk SKUs or queues tickets for manual approval on premium SKUs.

- Merchandising receives a digest of high-priority alerts (with supporting time-series snapshots and competitor links).

- Logistics and replenishment get inventory push if an unexpected sell-through spike appears.

Measuring business impact:

- Time-to-match: how quickly you can respond to a competitor's price event.

- Promo capture rate: portion of external promotions you successfully counter or leverage.

- Lost-revenue reduction: estimated revenue saved by avoiding stockouts or by timely price adjustments.

Closing the loop with Real-time liquor price tracking means turning external market movement into immediate, prioritized actions — reducing lost sales, defending margins, and seizing transient demand spikes. When combined with a mature Total Wine product data scraper and multi-retailer feeds, real-time tracking becomes your competitive reflex, not an occasional insight engine.

Why Choose Real Data API?

Real Data API brings exceptional advantages when you need robust, scalable Total Wine API scraping capabilities.

- Expertise & Reliability — We've built and maintained scrapers for large-scale retail environments. Our systems handle dynamic layout changes, anti-bot protection, IP rotation, and error recovery seamlessly.

- Scalable Infrastructure — From tens of thousands to millions of SKU records per day, our pipeline scales vertically and horizontally.

- Data Accuracy & Versioning — With change detection and snapshot pipelines, you'll see not just the current state but the full evolution over time.

- Custom Alerts & Integration — We support custom alert rules (e.g. price jump, stockout) and integrations (e.g. data pushed into your BI, cloud storage, or ML pipelines).

- Compliance & Ethics — Our approach is respectful of retailer terms, throttles responsibly, and uses best practices in data collection.

- Full-Service Support — Beyond just scraping, we help you build your analytics, clean data, normalize formats, and derive insights.

With Real Data API powering your Total Wine product data scraper, your business gets not just raw data but a strategic intelligence engine.

Conclusion

In an industry where margins can be tight and competition razor-thin, leveraging a Total Wine product data scraper transforms how you perceive and react to market forces. From building the Total Wine & More Liquor Dataset to running a Total Wine Scraper, assembling a Total Wine Inventory Monitoring Dataset, and executing Real-Time Liquor Price Tracking, every step composes a robust system for insights-first decision making.

If you want to Track Wine & Liquor Market Trends, compare performance across competitors, or harness Wine pricing data extraction to optimize your portfolio — Real Data API is your partner. Don't settle for lagging quarterly reports. Act in real-time, stay agile, and lead in your segment.

Reach out today to schedule a demo of our Total Wine data scraping service and see how Real Data API can elevate your wine & liquor business intelligence to the next level.

Source: https://www.realdataapi.com/total-wine-product-data-scraper.php

Contact Us:

Email: sales@realdataapi.com

Phone No: +1 424 3777584

Visit Now: https://www.realdataapi.com/

#TotalWineProductDataScraper

#TotalWineDataScrapingService

#WinePricingDataExtraction

#WebScrapingWineAndLiquorData

#RealtimeLiquorPriceTracking

#TotalWineApiScraping

#TrackWineAndLiquorMarketTrends

Comments

Post a Comment